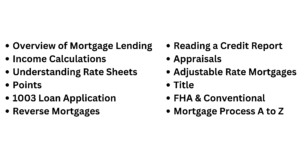

MLO BOOT CAMP INCLUDES

Here is a breakdown of some of the things you will learn in this course: There are 14 chapters with 2 large tests at the end. The first test is about mortgage knowledge, the second test is all mortgage calculations. Don’t worry, I have provided the answer keys, so you can score your test. Here are the highlights of each chapter

Mortgage Industry:This first chapter is just an overview of the mortgage industry. A way to ease you into what you are about to learn in greater detail.

Mortgage Calculations: This chapter on Mortgage Calculations is VERY intense. This chapter will walk you through basic mortgage calculations in a slow and deliberate way, so it becomes second nature to you. You will learn what a PITI payment is and how it works. Be ready to WORK HARD!

Mortgage Income Qualifying: In chapter three we will dive into mortgage income qualifying. You will learn the difference between paycheck income, commission income and tax-free income. You will also learn HOW MUCH a borrower might qualify for.

Points: Points! We have all heard the term points and we have all learned that POINTS ARE BAD! Too bad that’s WRONG! Points can be a GREAT thing is used properly. This chapter will teach you the correct way to use points for a great benefit to the borrower.

Rate Sheet: In this chapter you will learn how to read a rate sheet with precision. Even if your company does not use rate sheets as you see in this course, the computers pricing that you receive is based on these types of rate sheets.

1003 Mortgage Application: The “1003” mortgage application. This is the application that is behind the mortgage process. It’s where we gather much of the important information on a borrower, so the underwriter can make an informed decision. We will walk through all 10 sections and in addition I have included the modified “1003” that will be used in July 2018.

Credit Scores & Reports: This is yet again another one of those DEEP DOVE chapters. In chapter 7 you will learn more about credit than you ever knew before. I will walk you through many of the items that affect the credit score as well as teach you bout different types of scores. What I like to call the difference between a FICO score and a FAKE-O score! In this chapter we will actually read an entire credit report from start to finish.

TRID: Until 2017 we used to send out disclosures called “Good Faith Estimate” and “TIL” and at closing we would use a “HUD 1” form for accounting. Today under the new rules of TRID (TILA RESPA INTEGRATED DOCUMENTS) we now send out “Loan Estimate” or “LE” and for closing we send the “Closing Disclosure” or “CD”. This chapter is more of an overview than a deep dive. It’s more about understanding the big picture here. You will learn to fill in the blanks at your office. For now, understanding WHY is more important.

Appraisals: Yet again, another VERY INTENSE chapter. I will teach you the MAJOR points about appraisals. In this chapter we will READ several major pages of an appraisal. You will lean about the law of substitution, what a sales comparison is as well as bracketing. After this chapter you will have an excellent appreciation of how valuable and important appraisers are to the mortgage process.

Adjustable Rate Mortgage: Ever wonder how an Adjustable Rate Mortgage works? Buckle up, it’s about to get real. Can you answer this question? Index + Margin = ______ ? By the end of this chapter you will understand WAY more than that. You may even decide that ARM’s are a GOOD loan as I am certain that you have heard how BAD adjustable rate mortgages are. This chapter will teach you the REAL DEAL.

Title Reports: Title reports are a critical part of all mortgage loans. Closings cannot take place until there is a free and clear title.This chapter will give you an overview of what to look for in a title report.

Type of Mortgages: This chapter will teach you some basic differences between some of the more popular types of mortgages.

Reverse Mortgages: Reverse Mortgages are very misunderstood. In addition, there are many loan officers that never do Reverse as well as those loan officers that ONLY do Reverse. I have no way of knowing if you will ever do a Reverse mortgage but it’s a good thing to at least have an understanding of how it works. This chapter will give you a better understanding of how Reverse mortgages work. Should you decide to learn more about Reverse Mortgages, look for courses specifically for Reverse Mortgages. I am in the process of writing a Reverse Course called “Boot Camp for Reverse Mortgages” but it will not be out for a while.

Pulling it all Together: The final chapter will tie the process together.

Test Your Knowledge: There are two tests. First one is 100 questions of mortgage knowledge. Second test is 75 questions of mortgage calculations.